New Show: Principal Tech E1 – Is UK Contracting Worth It?

04 November 2021 Comments off

Reading time:

5 minutes

Word count:

1019

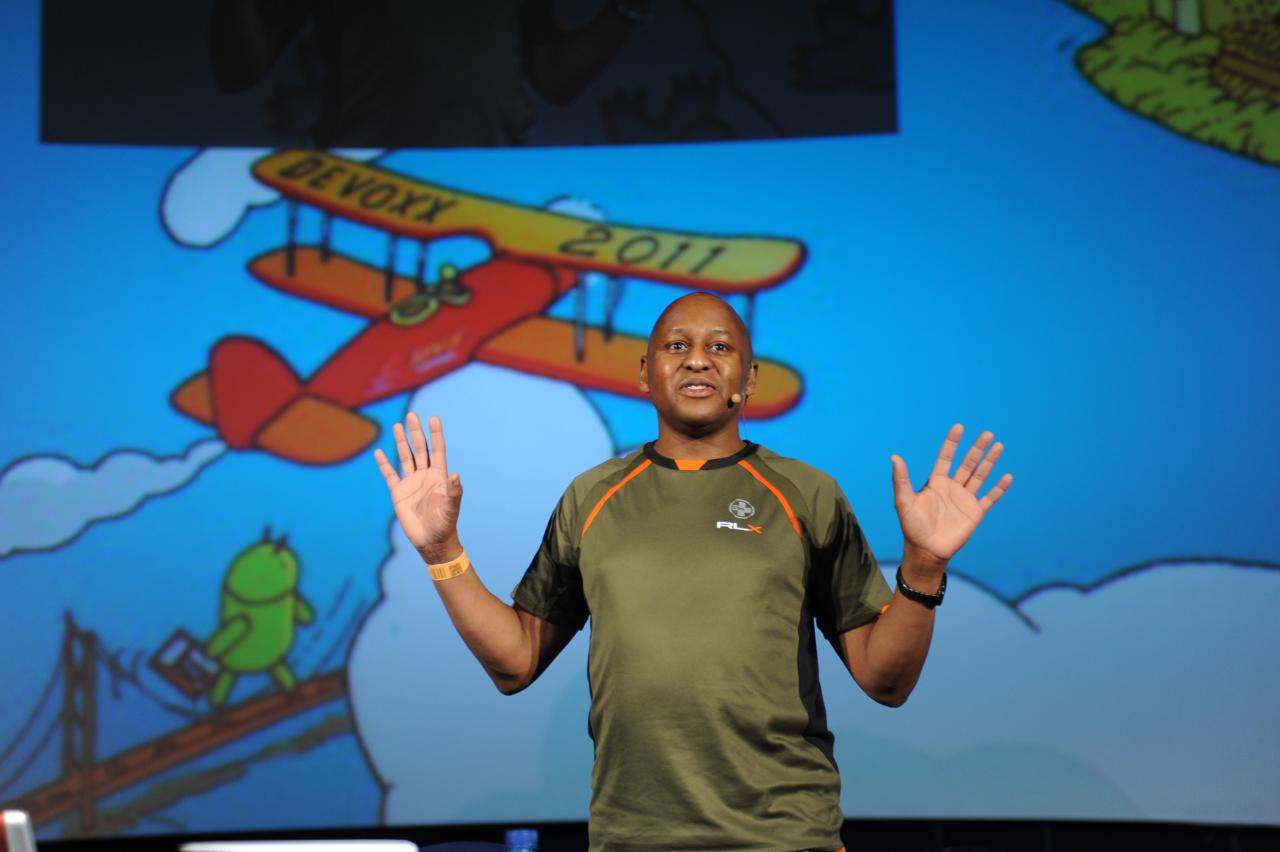

I have a new show Principal Tech E1 – Is UK Contracting Worth It? I uploaded the first episode to YouTube and I will add more shows for the foreseeable future. I am the Principal Technologist.

In the autumn 2021, I had many enquiries about this nature of work. Some people have been asking me about UK contracting. I had plenty of emails from recruiters recently. A few folk have asked for my advice, whether to go contracting. Disclaimer: I stopped contracting through my Limited company and became a permanent employee again, since the earlier this year, during the midst of the pandemic. I know some people will violently disagree with some my opinion, but you know better than me, these people. Well good luck to those of you all then. If you don’t know I published videos about Outside IR35, Off Payroll Worker rules on YouTube already.

My best advice is go and start reading the threads at UK Contractor Form / Business. , because you find many contractors, former contractors and experienced people, discussion the business of contracts anonymously.

For this first episode, I humbly welcome your comments and feedback.

To be honest, I cannot promise how regular this output Principal Tech show will be. I will see how it goes. Remember, please, this is not my day job, I must also earn a living and serve my client, I mean, employer, but at this time, as I write this, I already have the second episode recorded.

And by the way, if you even don’t care about UK contracting, that is also fine. You are not the one, luckily for you, who have lost thousands of pounds (£) of income. You can thank your lucky stars, you have not burned through your savings, you can also be very pleased that the Sun always shines on TV (see what I did there?) and that it never rains where you live and work (I do like rain in the forest whilst walking the dogs, it is how the Earth replenishes itself – COP26 shout out to you too!).

You also don’t care if you are foreigner, because that is really good, because I don’t think you want to contract in Britain in the way the government has issued new rules. If I were you I would find another country other the UK that does penalise Personal Service Companies with blanket tax legislation rules like Off Payroll Worker, where you can buy a superfast Apple MacBook Pro 16″ (2021 edition) with M1 Pro Max chip, 32GB and 2TB HDD and decent graphic chip, your choice, and you can expense this machine to your Limited Company account and then pay less Corporate Tax. This is a legitimate business expense in my view just travelling to work, living and working away from home in hotel, temoporary appartment, renting an office and driving up and down in car. This was / is the dream of so-called Outside IR35 contracting. At least it was up and until 31st December 2019, then everything went south, after that.

With so-called Inside IR35 contracting, those big doors to the business expense claims are firmly shut. Ergo, you can no longer claim any type of travel expense (car, rail, boat or airplane), or living away from home expenses, hotel or flat, conference fees and venues; you cannot buy insurance, you cannot claim membership fee of professional organisations, if you need then for architecture (the physical kind), civil engineering, or medical practitoniser duties (surgery and BMA), neither can you claim a superduper Apple MacBok Pro 16″ (2021 edition) nor a very cheap Dell Vostro machine. Those options are gone, sadly. Because you are working through an Umbrella Company, and worse of all, you might find your monthly Salary Paid in Arrears. That’s right! When you work as an Inside IR35 contractor (for the man, you think), say, for the whole month of January 2022, but nothing reaches your personal bank account (you are not allowed to your UK Limited Company account, because it does not make sense for salary) until 21st February 2022. Why? Because the Umbrella Company has to get the readies (payment) first from the Client-Co company. And for a few select umbrella companies, that could be up to 45 to 60 days in arrears. Now compare that to an employed person.

Oh wait! Why are you contracting then? When you have lost the right to claim business expense, you don’t have a VAT registration or a Company House number any more, what is exactly the point to contracting? Is it just a title? A brand? You are just a second-class worker in the end. Because if is Inside IR35, you are taxed a source, just like an employee. You money is deducted National Insurance, Apprentice Levy and of course, you pay opt-in by default, state pension. If you take a day off for holiday, or get sick (any kind of serious sickness) then you lose pay. An employee of the second-class division and taxed at source, then, but without the standard legal benefits of an employee. Worse, you cannot use your LTD company, so no dividend pay, no low salary and of course no need for corporation tax and the accountants to go with it. Well go with it, #InsideIR35 #contractor. We love it. Right?

Are you still clueless? Please, then, go borrow a copy of Rich Dad, Poor Dad; YES! I know it’s a freaking American book, quite ancient now, but if memory serves, it explains the financial concepts of setting up a business (a Personal Service Company (PSC) over here) or why anyone wants to own a legal entity extremely well, at least in the first half of the book. (Oh man, I agree with you 100% that the other half of Robert Kiyosaki’s classic book, is a bit nonsense, balderdash, especially, on this side of the Atlantic)

Yeah! But like I said, I am happy for you, because if all is well in your world and the sun will keep shining, well you know it. Shine on then!

Peter Pilgrim, November 2021

(PS: If you are working happily in foreign company as a PSC, please comment and give feedback 😉